Opendoor’s Comeback and the Power of Community Capital

Opendoor's value fell from $18B to $1B. Now they've got an ex-Shopify CEO and are ready to make a comeback.

Big product news this week: Shopify’s COO Kaz Nejatian has left Shopify to become the CEO of Opendoor, an online platform for buying and selling homes.

If you haven’t been following Opendoor, here’s their wild ride so far:

🚀 2020 SPAC Hype

Back during the SPAC craze of 2020, Opendoor went public through a SPAC (Special Purpose Acquisition Company) led by Silicon Valley venture capital investor Chamath Palihapitiya. At the time, Chamath’s infamous one-pagers painted iBuying as a category-defining revolution.

📉 The 2022 Crash

By 2022, the housing market turned. Rising interest rates squeezed Opendoor’s margins, and Opendoor lost $1.4B in a single year, more than double the losses from 2021. The board responded by appointing CFO Carrie Wheeler as CEO to instill operational discipline.

The damage was done: before the IPO, the company was valued at $18B, but by 2023 the company was valued at $1B.

🔄 The Comeback: Founders + Community Capital

Fast forward to 2025 and shares of Opendoor are up nearly 700% in the last 6 months. Here’s why:

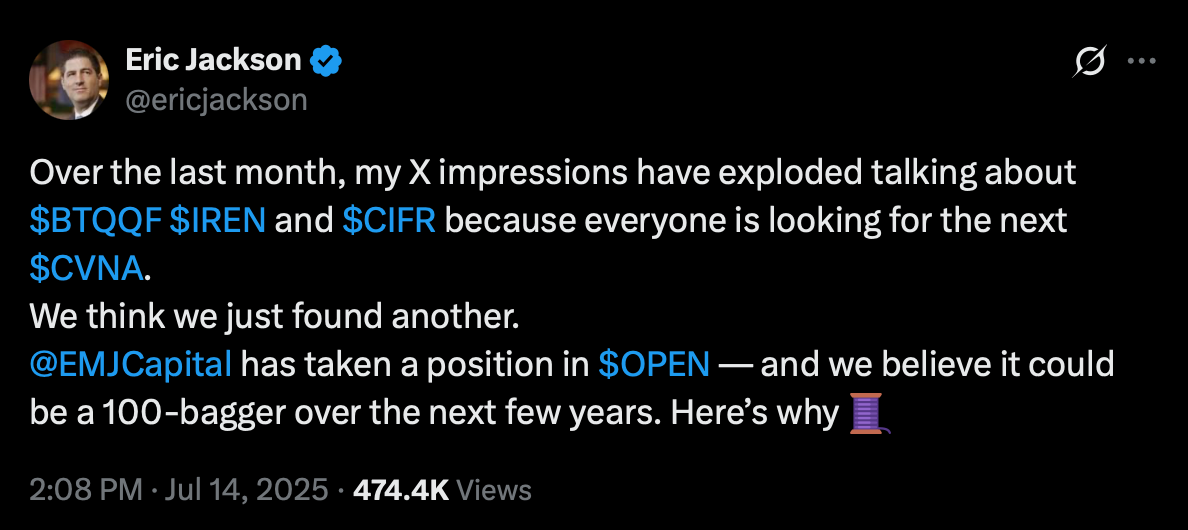

July 2025: Shares started to rally after Eric Jackson (EMJ Capital) went public with his bullish thesis about Opendoor on X.

August 2025: According to Yahoo Finance and CNBC, retail investors also succeeded in pressuring CEO Carrie Wheeler to step down.

September 2025: Co-founders Eric Wu and Keith Rabois rejoined the board, investing $40M of their own money into the company. Shopify’s ex-COO Kaz Nejatian steps in as CEO of Opendoor.

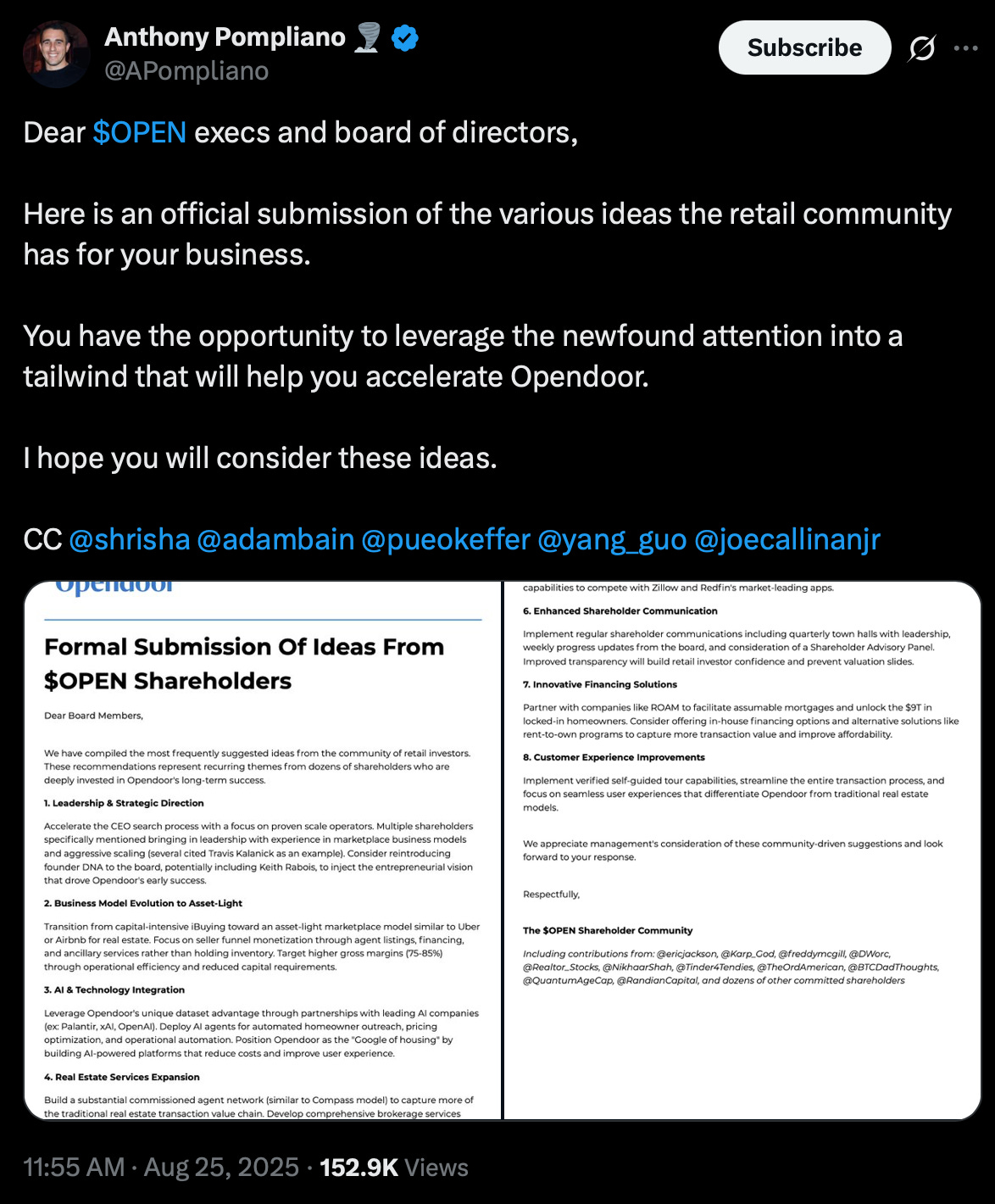

As investor Anthony Pompliano wrote on X:

“Retail investors are now a hive mind working together to identify opportunities, take financial positions, and advocate for improvements at target companies…Look at the hundreds of product suggestions that people have sent to Opendoor executives.”

Think about that: this isn’t just a meme stock.

This is a company that the investor community believes in.

And the retail investor community isn’t just trading the stock and riding the wave.

They’re shaping the leadership, the product, and the future of the company.

🔋 The Power of Community Capital

The Opendoor community of retail investors creates narrative momentum that powers:

Leadership: retail investors put pressure to make a leadership change happen, which made room for an AI and platform-visionary CEO like Kaz Nejatian to step in.

Talent: Retail investor hype has already created a ready-made talent pool for Kaz to recruit from.

Customers: In Opendoor’s case, many investors will also become sellers or buyers on the platform, seeding transaction volume.

Confidence: A strong community buffers against external doubt, giving leadership more space to execute.

Feedback: The community of retail investors contributes ideas and feedback to Opendoor, creating a flywheel for iteration.

💡 Takeaway for Product Builders

Last week I wrote about how community drives distribution. Opendoor shows us something bigger: community is capital.

It creates narrative momentum, attracts talent, shapes product direction, and seeds demand.

For product builders at any stage:

Own the relationship with your community. They are more than “users” or “investors”, they are believers. And don’t rely solely on platforms like Reddit or X; build direct channels with your believers (see strategies in last week’s post).

Listen to investor and customer feedback. Both groups are motivated to help you succeed. One of the most useful user feedback sessions I had was with a retail investor: because they really care about the company.

With the power of community, even a company that’s been through the wringer can get another shot at rewriting their destiny. I can’t wait to see what Opendoor, with Kaz Nejatian at the helm, does next.