Vibe Coders vs. DocuSign

The most obvious targets for vibe coding have become DocuSign and Calendly. What can Product Builders do to stay ahead?

In the past months, vibe coding has taken the tech world by storm. The idea is that with today’s AI coding tools like Lovable, Cursor, Bolt, and v0 (to name just a few), a solo developer can spin up a replica of incumbent SaaS products in record time.

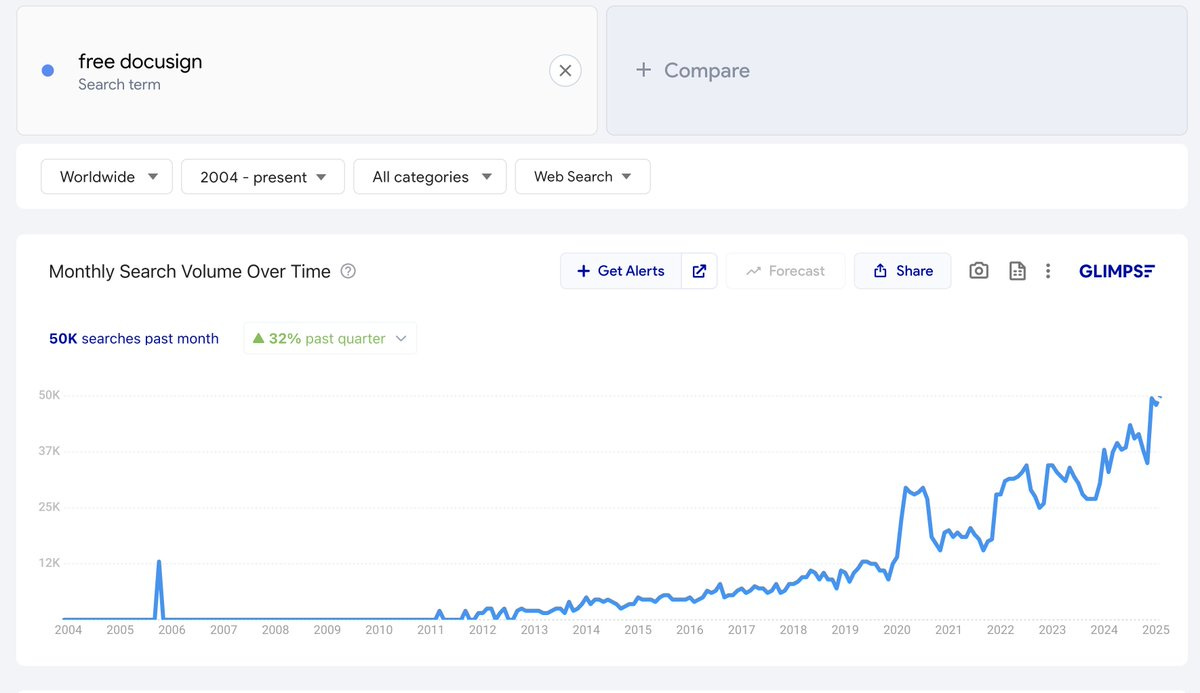

Naturally, the most obvious targets have become simple, straight-forward products that everyone understands, like DocuSign and Calendly. And that’s why DocuSign became the poster child for the vibe coding conversation.

Greg Isenberg encapsulated this idea earlier this year in a post on X:

“I don't know why a bunch of vibe coders don't band together to vibe code free AI-powered alternatives to SaaS incumbents like Figma, Adobe, DocuSign, etc. This gotta be the most obvious $100M+/year startup idea of our time,”

A DocuSign Clone in a Weekend?

Michael Luo, a Product Manager at Stripe, proceeded to vibe code a Docusign alternative in two days over the weekend (and later got a cease & desist from DocuSign).

If products like DocuSign, which previously took years to develop, are becoming this easy to copy, what’s actually protecting their throne? 🤔

Trust: The Part You Can’t Vibe Code 🔒

Michael Luo’s project exposed something: building a functional e-signature app is the easy part. The hard part? Building a trusted e-signature service. (Side bar: this Reddit post provides an excellent breakdown of what it takes to build a trusted e-signature product.)

Getting software to capture signatures isn’t rocket science. But convincing a large bank to use your tool for million-dollar contracts? That’s a whole different game.

E-signing documents is inherently sensitive, and the content inside those documents is highly confidential. Enterprise customers (and even individuals) care about security, legality, and reliability.

Replicating DocuSign’s code was the easy part; replicating its credibility is the real challenge.

Exposing DocuSign’s vulnerability

Even as a thought experiment, the headlines on X did expose a gap in DocuSign’s business model: the core product is easy to copy.

But even before vibe coding became a thing, DocuSign had already started expanding its product beyond simple e-signatures.

The company has quietly built a broader platform around the agreement process, aiming to make itself relevant at every stage of a contract’s life cycle. In recent years, DocuSign has moved “upstream” into contract preparation and generation, and “downstream” into post-signature management, using automation and AI. A few examples:

Workflow Automation: DocuSign launched a no-code automation platform called Maestro that lets companies orchestrate and automate the time-consuming business processes around the signature process. (Think automatically preparing a contract, collecting signatures, and storing the contract data in Salesforce or other 3rd party apps.)

Identity verification & security: Knowing who is signing is crucial for trust. DocuSign added options for enhanced ID verification, like checking passports or driver’s licenses, and even biometric checks for signers.

Contract AI: DocuSign has accumulated a treasure trove of contract data and legal knowledge since becoming the e-signature authority. They’re now leveraging that with AI, like AI contract agents that can flag risky or contradictory clauses in your contract.

Their product strategy is clear: make DocuSign a one-stop shop for everything related to agreements.

The e-signature may be commoditized over time, but DocuSign is digging their moat by innovating both upstream and downstream and creating an ecosystem around the e-signature.

Box’s Play: Bundle It 📦

Interestingly, another company in the content/document space has taken a different approach to e-signatures. Box started offering its own DocuSign alternative called Box Sign a few years ago. And it’s bundled for free with their existing SaaS offering.

Box’s strategy diverges from DocuSign in that their goal is to be a one-stop platform for all enterprise content and file storage needs: storing files, sharing/collaboration, data security governance, and now automation and AI.

Box faced a similar threat to DocuSign in that their core product, enterprise file sharing, was facing a commoditization threat.

Think about it: there’s nothing inherently “high-value-add” about storing files, and other than switching costs, there was not a ton of “stickiness” to their product offering.

Box responded by infusing AI into content management and collaboration, also working “upstream” and “downstream” of their original core feature set. For example, Box has recently sprinted to introduce:

Box Hubs: curated, topic-specific content portals inside an organization. Think of an HR Hub containing all HR policies, or a Sales Hub with playbooks and pitch decks, with the power to search them and get answers powered by AI. By narrowing the AI’s scope to vetted content posted in the Hub, Box reduces irrelevant answers and hallucinations. It’s a smart way to leverage AI for enterprise knowledge management and solves the “credibility problem” users face when using AI to search through all un-vetted enterprise documents.

Automated Workflows and Data Extraction with AI: Box also introduced tools for AI-driven metadata extraction and content automation. A great example: a legal team could create an app that scans contracts stored in Box and pulls out key terms (dates, parties, renewal clauses) and create a process workflow to send a contract out for signature. (If you’re thinking this sounds similar to DocuSign’s Maestro, you’re right, except Box Apps can handle workflow automation for domain areas beyond Legal like Accounting, HR, Sales, and Marketing).

At the helm of their reinvention is Aaron Levie, who has been vocal about the adoption of AI internally and in the product offering.

What Product Builders Need to Know:

As vibe coding makes once hard-to-build features into commodities, Product Builders (and probably Calendly) should take notes from DocuSign and Box’s product roadmaps.

Build a platform, not a stand-alone feature. If your entire business is built on one standalone feature, you’re vulnerable. A standalone feature is easy to copy; a platform of interlocking features is not. Box integrated AI and automated workflows into its content cloud to continuously make the whole product more valuable than the sum of parts. Similarly, DocuSign is integrating signing, storage, ID verification, and automation into an agreement ecosystem.

Own the workflow. Don’t stop at solving one step of the user’s journey. Map out everything the user does before and after the step that is your core product offering, and look for opportunities where your product can absorb those before and after steps. Just like Box is building for all parts of the enterprise content workflow, and Docusign is building all parts of the agreement workflow, Builders should consider how their product can be part of a larger workflow (via integrations or by building complementary features) to increase stickiness.

Build trust, not sensational headlines. As I said last week, trust is the moat. DocuSign’s brand conveys a level of trust in legality and security. Box has built a reputation in content security for the enterprise. If you handle important user data or processes, make trustworthiness part of your core value prop. That might mean obtaining certifications, transparently publishing uptime, offering top-notch support, and frankly marketing your reliability. As the old saying goes, “no one gets fired for buying IBM”. Your goal is to work to be that safe, trusted choice in your niche.

Build data moats. DocuSign is a prime example: it’s using years of agreements data (and knowledge of legal structure) to create AI that flags contract risks or conflicting terms. A new competitor can’t copy those features without the data or experience. Similarly, Box is able to reliably extract data from documents because of its experience with billions and billions of files stored on its platform. Product Builders should think about what data moats their products have – whether it’s user behaviour data or domain-specific content – and how to use AI or analytics to create AI-driven features that copy-cats can’t replicate. Plus, your proprietary product data creates a virtuous cycle: more users -> more data -> more proprietary insights -> better AI-driven features -> more value delivered -> more users.

Build an ecosystem of partners. More partnerships = more lock-in. Both DocuSign and Box understood this by building an ecosystem of integrations to make their platforms stickier. Docusign integrates with hundreds of other systems (Salesforce, Microsoft, Google, etc.) and Box integrates to act as the content layer for many other common enterprise tools (Office 365, Google, Salesforce files, Slack for notifications). No product can be an island in today’s cloud ecosystem.

Final word for Product Builders

A lesson delivered from the vibe coders is that no Product Builder can rest on their laurels.

Builders need to keep ahead of the commoditization curve.

DocuSign could have stuck to e-signatures, but it likely saw that e-signature tech was commoditizing, so it moved “upstream” and “downstream” into contract generation and workflow automation.

Box could have stagnated with its core file sharing offering, but Aaron Levie saw an opportunity to differentiate from other storage providers by adding AI into content and collaboration workflows.

We live in a world where “weekend projects” can achieve things that took established companies years to build.

But the smartest Product Builders will use that as motivation to keep raising the bar on their products.

💬 Let me know what you think: are vibe coders going to topple SaaS incumbents?